The different annuity methods result in different amortization schedules. At times, amortization is also defined as a process of repayment of a loan amortization examples on a regular schedule over a certain period. Negative amortization is when the size of a debt increases with each payment, even if you pay on time.

Paying Off a Loan Over Time

However, there is a key difference in amortization vs. depreciation. For intangible assets, knowing the exact starting cost isn’t always easy. You may need a small business accountant or legal professional to help you.

Amortization Schedule

- It is typically a long-term loan, often with a fixed-rate and amortization schedule, where the payment consists of both principal and interest.

- Negative amortization is when the size of a debt increases with each payment, even if you pay on time.

- The lender can adjust the rate on a predetermined schedule, which would impact your amortization schedule.

- A fixed-rate mortgage is one of the most common types of amortizing loans.

- The best way to understand amortization is by reviewing an amortization table.

Patriot’s online accounting software is easy-to-use and made for small business owners and their accountants. With the above information, use the amortization expense formula to find the journal entry amount. Residual value is the amount the asset will be worth after you’re done using it.

#2. Declining balance method

Amortization is an important concept not just to economists, but to any company figuring out its balance sheet. For clarity, assume that you have https://www.bookstime.com/ a loan of $300,000 with a 30-year term. Due to uncertain and continuous technological advancements, the software does not have a remaining value.

Business Perspective

Therefore, the current balance of the loan, minus the amount of principal paid in the period, results in the new outstanding balance of the loan. This new outstanding balance is used to calculate the interest for the next period. There are several different ways to calculate amortization for small businesses. Some examples include the straight-line method, accelerated method, and units of production period method. These regular instalments are generated using an amortization calculator.

The cost of business assets can be expensed each year over the life of the asset to accurately reflect its use. The expense amounts can then be used as a tax deduction, reducing the tax liability of the business. Once you know your monthly payment, you can create an amortization schedule that shows how much of each payment goes toward interest and how much goes toward the principal. For example, if a company spends $100,000 to acquire a patent, it might amortize that cost over 10 years, recognizing $10,000 in expenses each year. This process helps businesses match expenses with revenue, providing a clearer picture of profitability. An amortized loan tackles both the projected amount of interest you’ll owe and your principal simultaneously.

Is amortization a good or bad accounting technique?

Now that intangible assets are considered long-lived assets in the economy, accountants will have to amortize their amount over time when preparing financial statements. Within the framework of an organization, there could be intangible assets such as goodwill and brand names that could affect the acquisition procedure. As the intangible assets are amortized, we shall look at the methods that could be adopted to amortize these assets. Amortization helps compare the cost of a business purchase with a business combination by providing a structure to spread out the cost of intangible assets over time. Businesses can tie the cost of their assets by allocating a portion of the cost as amortization expenses in their books and reducing their taxable income over their lifespan.

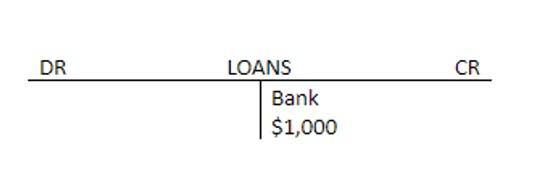

Use of Contra Account

With an amicably agreed interest rate, the amortization period can also provide the amount that will be paid as the monthly installment. The purchase of a house, or property, is one of the largest financial investments for many people and businesses. This mortgage is a kind of amortized amount in which the debt is reimbursed regularly. The amortization period refers to the duration of a mortgage payment by the borrower in years. Financially, amortization can be termed as a tax deduction for the progressive consumption of an asset’s value, in particular an intangible asset.

Add comment